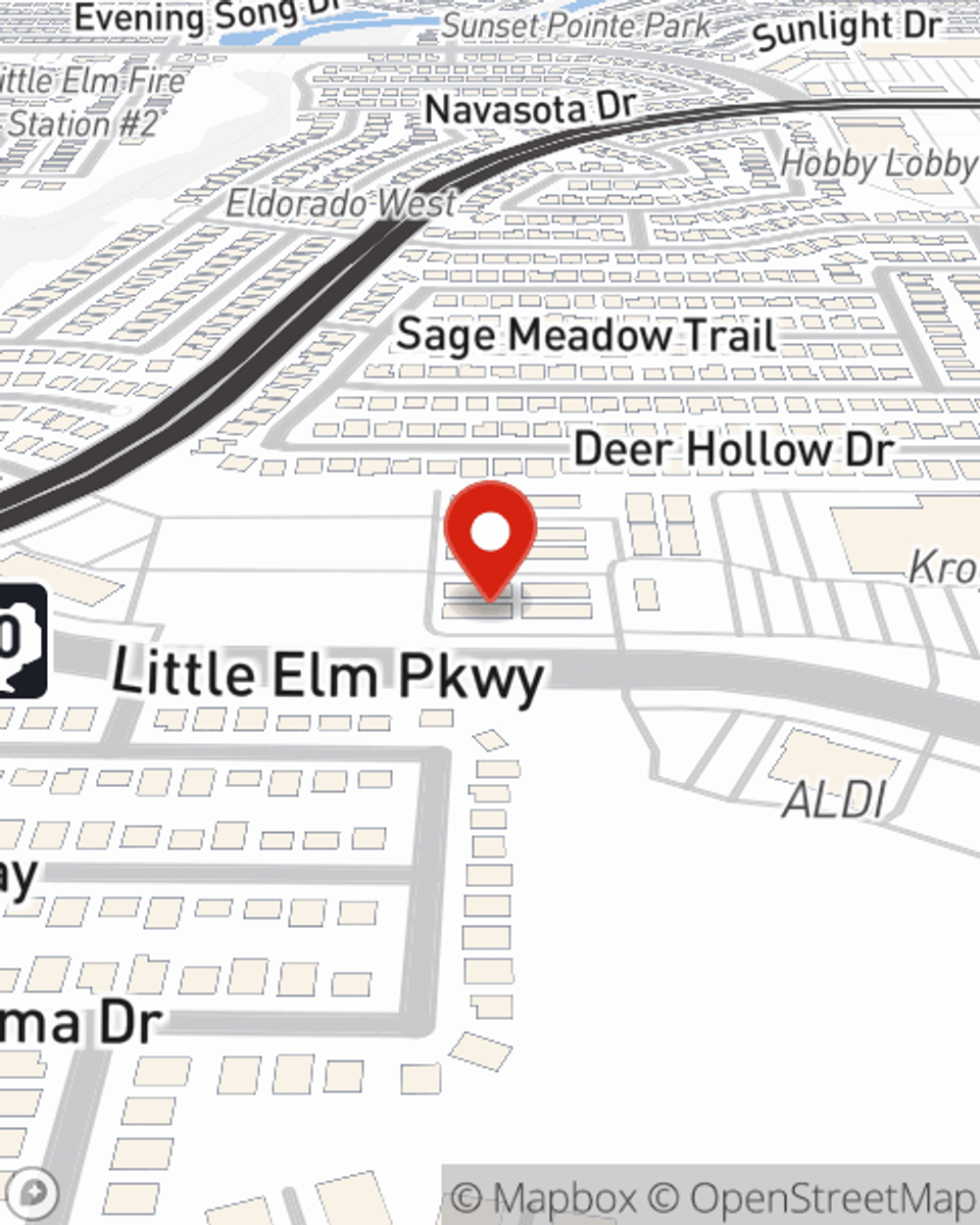

Business Insurance in and around Little Elm

One of Little Elm’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Your Search For Excellent Small Business Insurance Ends Now.

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected catastrophe or problem. And you also want to care for any staff and customers who get hurt on your property.

One of Little Elm’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

With State Farm small business insurance, you can give yourself more protection! State Farm agent Justin Bigby is ready to help you handle the unexpected with dependable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Justin Bigby can help you file your claim. Keep your business protected and growing strong with State Farm!

Curious to discover the specific options that may be right for you and your small business? Simply call or email State Farm agent Justin Bigby today!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Justin Bigby

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.